PERTH, Australia, July 30, 2024 /PRNewswire/ –

Highlights

Hot Chili Secures A$31.9 Million Funding to Accelerate Costa Fuego Copper Hub

A$24.9 million private placement (Placement) to institutional and professional investors

An additional A$7 million raised in Share Purchase Plan to all existing eligible shareholders at the same offer price as the Placement

Funding facilitates completion of the Costa Fuego Pre-Feasibility Study, completion of the Water Supply Business Case Study, completion of the Costa Fuego Environmental Impact Assessment, commencement of a bankable feasibility study and further exploration activities over the next 18 months

Hot Chili Creates New Water Company – Huasco Water

Hot Chili and its partner, Chilean iron ore company Compania Minera del Pacifico (CMP), have established a new water company called “HW Aguas para El Huasco SpA” (Huasco Water)

Hot Chili holds an 80% interest in Huasco Water and CMP holds a 20% interest

Transfer of all critical water assets (maritime water extraction licence, water easements, costal land accesses and second maritime application) to Huasco Water has commenced

Business Case Study underway for a potential multi-user water business, supplying sea water and desalinated water to the Huasco Valley region of Chile, where Huasco Water has a first-mover advantage

Hot Chili set to be a foundation water off-taker for Huasco Water, and discussions with other potential water off-takers and potential infrastructure partners are progressing well

Costa Fuego Pre-Feasibility Study On-Track

Advancement of multiple development study workstreams, including drilling operations in support of metallurgical and hydrogeological studies

Pre-Feasibility Study (PFS) for Costa Fuego copper-gold project planned for completion in late 2024

Exploration Activities Underway in Advance of Growth Drilling

Deep penetrating, high resolution MIMDAS and Ground Magnetics geophysical surveys completed at Productora and Cortadera

Ground Magnetics geophysical survey, surface soil sampling and geological mapping underway across the recently consolidated Domeyko landholding (Domeyko), located 30km south of Costa Fuego

Cash Position of A$33.8 Million

For more information contact:

Mr. Christian Easterday

Tel: +61 8 9315 9009

Managing Director

Email: admin@hotchili.net.au

Cautionary Statement – JORC Code (2012)

The Preliminary Economic Assessment referred to in this Report is equivalent to a Scoping Study under JORC Code (2012) reporting guidelines. It has been undertaken for the purpose of initial evaluation of a potential development of the Costa Fuego Copper Project in Chile. It is a preliminary technical and economic study of the potential viability of the Costa Fuego Copper Project. The PEA outcomes, production target and forecast financial information referred to in the report are based on low level technical and economic assessments that are insufficient to support estimation of Ore Reserves. The PEA is presented in US dollars to an accuracy level of +/- 35%. While each of the modifying factors was considered and applied, there is no certainty of eventual conversion to Ore Reserves or that the production target itself will be realised. Further exploration and evaluation and appropriate studies are required before Hot Chili will be in a position to estimate any Ore Reserves or to provide any assurance of any economic development case. Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the PEA.

Of the Mineral Resources scheduled for extraction in the PEA production plan, approximately 99% are classified as Indicated and 1% as Inferred. The Company has concluded that it has reasonable grounds for disclosing a production target which includes a small amount of Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised. The viability of the development scenario envisaged in the PEA does not depend on the inclusion of Inferred Mineral Resources. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued drilling.

The Mineral Resources underpinning the production target in the PEA have been prepared by a competent person in accordance with the requirements of the JORC 2012. For full details on the Mineral Resource estimate, please refer to the ASX announcement of 31 March 2022. The Mineral Resource Estimate update released in February 2024 does not materially change the Mineral Resource inventory that formed the basis of the 2023 PEA, and no new scientific or technical information has been developed that would materially affect the outcome of the 2023 PEA and, therefore, the results and conclusions of the 2023 PEA are considered current and have been restated for this Report.

To achieve the outcomes indicated in the PEA, including reaching Definitive Feasibility Study (“DFS”) and production stages, funding in the order of US$1.10 Billion will be required, including pre-production and working capital and assumed financing charges. Investors should note that that there is no certainty that Hot Chili will be able to raise that amount of funding when needed. One of the key assumptions is that the funding for the Project will be available when required. It is also possible that such funding may only be available on terms that may be dilutive to, or otherwise affect the value of, Hot Chili’s existing shares. It is also possible that Hot Chili could pursue other value realisation strategies such as debt financing, a sale or partial sale of its interest in the Costa Fuego Copper Project, sale of further royalties and/or streaming rights, sale of non-committed offtake rights, and sale of non-core assets.

This Report contains forward-looking statements. Hot Chili has concluded that it has a reasonable basis for providing these forward-looking statements and believes it has a reasonable basis to expect it will be able to fund development of the Costa Fuego Copper Project. However, a number of factors could cause actual results or expectations to differ materially from the results expressed or implied in the forward-looking statements. Given the uncertainties involved, investors should not make any investment decisions based solely of the results of the PEA.

SUMMARY OF OPERATIONAL ACTIVITIES

Costa Fuego Pre-feasibility Study On-Track

During the quarter, the Company has continued to focus on several development studies workstreams ahead of the planned delivery of the Pre-Feasibility Study (PFS) in late 2024.

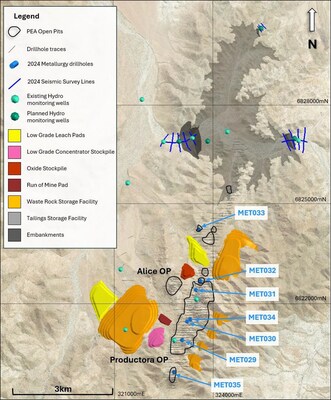

Development study drilling during the quarter has focussed on metallurgical and hydrogeological drill programs at Productora and the planned Tailings Storage Facility (TSF) for Costa Fuego. Seven diamond drillholes (405m) were completed at Productora during the quarter for metallurgical purposes. The resulting samples have been collected for further testwork on oxide and transitional material. Pre-existing diamond core at Cortadera has also been utilised for this testwork, which will confirm the application of NovaMineralis leach technology for the planned heap leach component of ore processing.

Hydrogeological and environmental studies of the planned TSF footprint also advanced significantly during the quarter, with a shallowly penetrating seismic survey completed in June in tandem with a diamond drillhole for calibration, incorporating hydrogeological permeability tests and geotechnical logging. Detailed surface geological mapping to define key hydrogeological domains was also completed. A further four water-monitoring bores are planned to be completed in Q3 2024.

Hot Chili’s development team have completed geometallurgical modelling of the concentrator throughput to facilitate advanced scheduling for optimised mine designs. Remaining geometallurgy workstreams will focus on acid consumption modelling in the planned heap leach and dump leach.

Open pit and underground cave mine design has progressed well with the economic limits at all deposits completed and pit staging being finalised. Mine designs are being independently reviewed for geotechnical stability and detailed mine designs have commenced.

On- and off-site infrastructure designs for the proposed material handling system (Doppelmayr’s rope conveyor technology) and infrastructure/utilities corridor between Productora and Cortadera (access, power and water supply) are being reviewed and optimised.

Hot Chili has also engaged several independent experts to review and provide assurance reports for all critical areas of the PFS such as the mineral resource, metallurgy, mine design, ore transport and handling, environmental permitting process, capital and operating costs. In all, fourteen assurance reports are being prepared. The assurance reporting process is nearing completion and will provide an additional level of expert review to the Independent Technical Review of the PFS, which has been awarded to engineering major Ausenco in conjunction with project management consultants Enthalpy during the quarter. The assurance reporting and Independent Technical Review process aims to ensure the delivery of a rigorous and robust PFS for Costa Fuego.

Port engineering studies being managed by Port of Las Losas are also progressing in consultation with Hot Chili development team. Port studies are being progressed in parallel with Costa Fuego’s development timeline to ensure both rotainer and bulk tonnage port loading options are available.

Geophysical Surveys Completed at Productora and Cortadera

Twenty-nine Line-kilometres (Lkm) of MIMDAS1 was completed from May to June across the Productora (12Lkm) and Cortadera (17Lkm) projects. This deep penetrating electrical geophysical technique detects the chargeability, resistivity, and conductivity properties of underlying rocks. The results of the surveys are currently under review, in combination with geological mapping, drillhole logging and existing geochemical datasets. 3D inversion of the

__________________________

1 MIMDAS refers to MIM Distributed Acquisition System, where MIM refers historically to the Mount Isa Mines company.

MIMDAS lines will also be completed, at Productora and Cortadera.

The new geophysical datasets will provide additional resolution for assessing several high priority growth targets located proximal to both of Hot Chili’s bulk tonnage copper-gold resources.

Exploration Activities Underway in Advance of Growth Drilling

On 30th April 2024, Hot Chili announced an option to acquire concessions known as the “Domeyko cluster” (Domeyko) within the historic Domeyko copper-gold mining centre, located approximately 30km south of Hot Chili’s planned central processing location (at Productora) for Costa Fuego. Domeyko covers an area of 141 km2 and represents a 25% increase in Hot Chili’s total landholding area at Costa Fuego.

The Domeyko mining centre hosts both porphyry and structurally controlled styles of mineralisation. Several significant historical copper-gold mines are present, which were previously exploited for oxide mineralisation with limited copper sulphide mineralisation exploration undertaken within the area.

During the quarter, the Company’s exploration team kicked-off several significant exploration programmes, including soil geochemistry, geophysics and surface mapping over this large area. An extensive Ground Magnetics survey comprised of 1755Lkm (on 100m spaced north-south oriented lines) is currently underway. The survey data collection is expected to be finalised early Q3 and will aid in targeting across this most recent addition to the Hot Chili tenement package.

SUMMARY OF CORPORATE ACTIVITIES

Hot Chili Closes A$31.9 Million Funding to Accelerate Costa Fuego

On the 6th of May 2024 the Company announced a A$24.9 million private placement to institutional and professional investors through the issue of 24,900,000 new fully paid ordinary shares (“Shares”) at an offer price of A$1.00 per Share (the “Placement”). The placement was facilitated by joint lead managers (together, the “JLMs”) Veritas Securities Limited and Cormark Securities Inc. and co-managers BMO Capital Markets and Beacon Securities Limited. Further details of the private placement are outlined in the Announcement dated 10 May 2024 “Hot Chili Closes A$24.9 Million Private Placement and Announces Full Underwriting of A$5 Million Share Purchase”.

In addition to the Placement, the Company offered a fully underwritten Share Purchase Plan (“SPP”) to all existing eligible shareholders at the same offer price as the Placement, A$1.00 (C$0.89) per Share. On the 27th of May, the SPP results were released. Given the overwhelming response to the SPP, which was closed early, the Board of Directors exercised its discretion under the terms of the SPP to increase the SPP offer to A$7 million, from the A$5 million originally targeted.

Proceeds from the Placement and SPP, in addition to existing treasury, will provide up to 18 months funding to be used for the completion of the Costa Fuego Pre-Feasibility Study, completion of the Water Supply Business Case Study, completion of the Costa Fuego Environmental Impact Assessment, ongoing exploration, drilling and consolidation activities, and for general working capital purposes.

Hot Chili Launches New Water Company – Huasco Water

Following the conceptual study completed by Hot Chili in Q1, a new joint venture water company Huasco Water (Hot Chili (though Sociedad Minera El Corazón SpA (SMEA)) 80% and CMP 20%) was formed (see announcement dated 8th July), with all water assets held by SMEA being transferred to the newly formed Huasco Water. Following transfer completion, Huasco Water will hold the only active granted maritime water concession, and most of the necessary permits, to supply non-continental water to the Huasco Valley. This will potentially unlock future mining developments in the world’s most prolific copper producing region.

HCH also submitted a second maritime concession application for the Huasco valley in April, which includes brine discharge for potential seawater desalination operations on the coastline, so that both raw seawater and desalinated water could be provided by a potential water network.

Huasco Water provides water supply security for Hot Chili as a foundation water off-taker – approximately 700l/s of seawater demand for Hot Chili’s Costa Fuego copper project. Discussions with other potential desalinated water off- takers and potential infrastructure partners are advancing well.

Recent third-party transactions in Chile (see announcement “Hot Chili Launches New Water Company – Huasco Water” dated 8th July 2024) have highlighted the strategic nature and implicit value of critical water access rights within the Atacama region, and an increasing trend in Chile towards outsourcing in the industrial infrastructure sector.

Importantly, Hot Chili’s approach toward potential outsourcing and development of shared infrastructure, in addition to preserving scarce continental water sources, is fast becoming the accepted and responsible approach for unlocking future mining developments in Chile

Huasco Water provides Hot Chili a potentially significant funding option for Costa Fuego, with the current Business Case Study set to review various monetisation options. Huasco Water’s Business Case Study is on-track and planned for completion in H1 2025.

Hot Chili Appoints New Company Secretary & Chief Financial Officer

Hot Chili Limited announced the resignation of Ms Penelope Beattie as Company Secretary and Chief Financial Officer effective 1 July 2024 and announced the appointment of Mrs Carol Marinkovich as interim Company Secretary for the Company, effective 1 July 2024.

Deborah Le Moignan was announced as Financial Controller and interim Chief Financial Officer (CFO) effective 1 July 2024. The CFO role has subsequently been appointed to Ryan Finkelstein, effective 15 July 2024; Deborah will remain in her position as Financial Controller with the Company.

Mr Finkelstein is a seasoned Chartered Accountant with over 14 years of experience, including 10 years in auditing at global mid-tier accounting firm Grant Thornton.

Cash Position and Capital Structure Changes

As of 30 June 2024, the Company had cash of A$33.8 million and no debt.

On 10 May 2024, the Company issued 24,900,000 new fully paid ordinary shares through a private placement, at an offer price of A$1.00 for aggregate gross proceeds of A$24.9m (before costs).

On 27 May 2024, the Company issued 7,000,000 new fully paid ordinary shares through a share purchase plan, at an offer price of A$1.00 for aggregate gross proceeds of A$7m (before costs).

The following securities on issue:

151,345,206 ordinary fully paid shares

1,850,001 AUD$2.25 options expiring 30 September 2024

1,259,789 options at CAD$1.85 expiring 31 January 2025

5,996,728 unvested services and performance rights. Conditions have been met for the vesting of 938,953 Service Rights and 290,480 Performance Rights.

Table 1 – Drill Holes Completed for Costa Fuego in Quarter 2 2024

Prospect

Hole ID

North

East

RL

Depth

Azimuth

Dip

Results

Productora Hydrogeology

PROMW05

6827019

323359

531

100.8

0

-90

Results Pending

Productora Metallurgy

MET029

6820934

323026

881

75

91

-59

Results Pending

Productora Metallurgy

MET030

6821494

323186

851

55

107

-59

Results Pending

Productora Metallurgy

MET031

6822450

323456

802

50.1

115

-56

Results Pending

Productora Metallurgy

MET032

6822710

323580

782

75

90

-60

Results Pending

Productora Metallurgy

MET033

6824261

323557

684

30

90

-57

Results Pending

Productora Metallurgy

MET034

6821561

323282

899

60

95

-60

Results Pending

Productora Metallurgy

MET035

6819973

322787

1007

60

91

-60

Results Pending

Note: No significant drill results have been returned in Q2 2024, all metallurgical holes completed within the Productora Mineral Resource and within close proximity (twinned holes) to existing drill holes previously reported.

ASX Listing Rule 5.3.2: There was no substantive mining production and development activities during the quarter.

ASX Listing Rule 5.3.3 – Schedule of Mineral Tenements as of 30 June 2024

The schedule of Mineral Tenements and changes in interests is appended at the end of this activities report.

ASX Listing Rule 5.3.4: Reporting under a use of funds statement in a Prospectus does not apply to the Company currently.

ASX Listing Rule 5.3.5: Payments to related parties of the Company and their associates during the quarter per Section 6.1 of the Appendix 5B totalled $163,000. This is comprised of directors’ salaries and superannuation of $163,000

Field operations during the period included geological reconnaissance activities, reverse-circulation drilling, diamond drilling, core-testing and logging, field mapping, and sampling exercises across the major Cortadera and Productora landholdings, as well as new tenements at Domeyko. Activities on new tenements are run from the Productora or Cortadera operations centres and their safety statistics are included under the figures for all projects.

There was one Lost Time Injury (LTI) in the Quarter. Significantly, a leg fracture incident occurred during a soil sampling field programme. The LTI triggered an incident review and a refresher training on field safety protocols for all appropriate exploration field staff. Terrain assessment vs data coverage during planning was identified as one opportunity to mitigate potential future reoccurrence.

Hot Chili’s sustainability framework ensures an emphasis on business processes that target long-term economic, environmental and social value. The Company is dedicated to continual monitoring and improvement of health, safety and the environmental systems. There is no greater importance than ensuring the safety of our people and their families.

Table 2. HSEQ Quarter 2 2024 Performance and Statistics

Deposit

Productora

Cortadera

All Projects

Timeframe

Q2 2024

Cum.²

Q2 2024

Cum.²

Q2 2024

Cum.²

LTI events

0

0

0

6

1

8

NLTI events

0

4

1

6

1

11

Days lost

0

0

0

152

88

263

LTIFR index

0

0

0

21

127

20

ISR index

0

0

0

527

6

647

IFR Index

0

54

0

42

0

47

Thousands of manhours

8.4

74

5.0

288

15.9

407

Incidents on materials and assets

0

1

0

0

0

1

Environmental incidents

0

0

0

0

0

0

Headcount¹

24

10

16

33

15

51

Notes: HSEQ is the acronym for Health, Safety, Environment and Quality. LTIFR per million-manhours. Safety performance is reported on a monthly basis to the National Mine Safety Authority on a standard E-100 form; (1) Average monthly headcount (2) Cumulative statistics since April 2019.

During the Quarter, Hot Chili’s subsidiary, Sociedad Minera La Frontera Spa (“La Frontera”) entered into an option to purchase agreement with a private Chilean syndicate holding 100% interests in 12 Exploration and 14 Exploitation concessions for the grant to Frontera of an option to acquire a 100% interest in the concessions (“Domeyko Option” or “Option Agreement”).

The other parties to the Option Agreement are Sociedad Legal Minera Unes Una de la Quebrada San Antonio (SLMQ); Compania Minera Algarrobo Limitada) (“CMAL”) and John Arturo Hunter Flores (“JHF”), collectively “Owners”. The Option Agreement also includes any water rights that may correspond to the properties, mining easements and rights of any kind over the corresponding surface lands and all other rights and permits that are legally annexed to the properties.

Further details of the transaction are outlined in the Announcement dated 30 April 2024 “Hot Chili Secures Large Addition to its Costa Fuego Coastal Copper Hub in Chile“.

Table 5. Current Tenement (‘Patente’) Holdings in Chile as of 30 June 2024

License ID

HCH % Held

HCH %

Earning

Area

(ha)

Agreement Details

MAGDALENITA 1/20

100% Frontera SpA

100

ATACAMITA 1/82

100% Frontera SpA

82

AMALIA 942 A 1/6

100% Frontera SpA

53

PAULINA 10 B 1/16

100% Frontera SpA

136

PAULINA 11 B 1/30

100% Frontera SpA

249

PAULINA 12 B 1/30

100% Frontera SpA

294

PAULINA 13 B 1/30

100% Frontera SpA

264

PAULINA 14 B 1/30

100% Frontera SpA

265

PAULINA 15 B 1/30

100% Frontera SpA

200

PAULINA 22 A 1/30

100% Frontera SpA

300

PAULINA 24 1/24

100% Frontera SpA

183

PAULINA 25 A 1/19

100% Frontera SpA

156

PAULINA 26 A 1/30

100% Frontera SpA

294

PAULINA 27A 1/30

100% Frontera SpA

300

CORTADERA 1 1/200

100% Frontera SpA

200

CORTADERA 2 1/200

100% Frontera SpA

200

CORTADERA 41

100% Frontera SpA

1

CORTADERA 42

100% Frontera SpA

1

LAS CANAS 16

100% Frontera SpA

1

LAS CANAS 1/15

100% Frontera SpA

146

CORTADERA 1/40

100% Frontera SpA

374

LAS CANAS ESTE 2003 1/30

100% Frontera SpA

300

CORROTEO 1 1/260

100% Frontera SpA

260

CORROTEO 5 1/261

100% Frontera SpA

261

PURISIMA

100% Frontera SpA

20

1.5% NSR

MAGDALENITA 1/20

100% Frontera SpA

100

Note. Frontera SpA is a 100% owned subsidiary company of Hot Chili Limited

Productora Project Tenements

License ID

HCH % Held

HCH %

Earning

Area

(ha)

Agreement Details

FRAN 1, 1-60

80% SMEA SpA

220

FRAN 2, 1-20

80% SMEA SpA

100

FRAN 3, 1-20

80% SMEA SpA

100

FRAN 4, 1-20

80% SMEA SpA

100

FRAN 5, 1-20

80% SMEA SpA

100

FRAN 6, 1-26

80% SMEA SpA

130

FRAN 7, 1-37

80% SMEA SpA

176

FRAN 8, 1-30

80% SMEA SpA

120

FRAN 12, 1-40

80% SMEA SpA

200

FRAN 13, 1-40

80% SMEA SpA

200

FRAN 14, 1-40

80% SMEA SpA

200

FRAN 15, 1-60

80% SMEA SpA