BOGOTA, Colombia, Feb. 29, 2024 /PRNewswire/ — We ended 2023 with strong operational results that drove achievements across the entire company. We have achieved the second-best financial results in history by following our financial planning, enhancing our traditional business, and managing the steps toward the energy transition.

Throughout 2023, it’s worth noting that Brent crude oil prices experienced a decline in 2023 compared to 2022, dropping from USD 99 per barrel to USD 82 per barrel. This decline can be attributed primarily to the slow economic recovery in China and an increase in non-OPEC crude oil supply. Moreover, geopolitical challenges and inflationary pressures further impacted our operational costs during this period.

Nevertheless, Ecopetrol’s commercial strategy capitalized on increased demand for our crude oils due to OPEC+ production cuts and limitations in Canadian crude supply. Simultaneously, differentials for our refined products remained strong compared to historical levels, allowing us to leverage the growth in our refinery capacity.

In addition to this, in 2023, we achieved significant milestones:

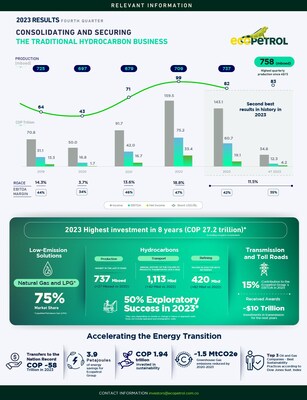

In hydrocarbons, we achieved the highest annual production figure in the last eight years (737 mboed), the highest annual volumes transported (1,113 kbd), including the highest movement through multipurpose pipeline (306 mboed) in the history of the Company, and a historical record for consolidated refining throughputs (420 mboed).

In exploration, we achieved an exploratory success rate reached 50%, with Glaucus-1 standing out, confirming the offshore potential of the Colombian Caribbean in Gorgon. Additionally, the commencing drilling of the Orca Norte-1 well, 100% by Ecopetrol.

In investments, we achieved a 97% execution rate for the year, the highest level in the last 8 years (COP 27.2 trillion).

We closed the year with a balance of COP 20.5 trillion in the Fuel Price Stabilization Fund (FEPC) and an accumulation rate lower by ~44% compared to 2022.

In January 2024, we successfully issued bonds in the international market as part of the company’s refinancing strategy, demonstrating strong investor appetite for our debt securities.

We transferred COP 58 trillion to the Nation, marking a historical annual record.

Financial results were aligned with operational dynamics and exceeded the main goals outlined in our Financial Plan. In the fourth quarter of 2023, we recorded revenues of COP 34.8 trillion, a net profit of COP 4.2 trillion, an EBITDA of COP 12.3 trillion, and an EBITDA margin of 35%. For the full year, we achieved consolidated revenues of COP 143.1 trillion, a net profit of COP 19.1 trillion, an EBITDA of COP 60.7 trillion, and an EBITDA margin of 42%. The gross debt/EBITDA indicator stood at 1.7 times, the return on capital employed (ROACE) was 11.5%, and the cash balance was COP 14.3 trillion.

The hydrocarbons business line recorded notable achievements in 2023, including declaring 11 successful wells, with three exploratory successes in the fourth quarter: Zorzal Este-1, Magnus-1, and Bisbita Centro-1. The Orca Norte-1 well, drilled in 2023 and appraised in January 2024, confirmed the presence of two gas accumulations in reservoirs other than the Orca-1 discovery, triggering a re-evaluation of the original project while expanding the gas potential of La Guajira Offshore.

In terms of production, we achieved an average of 737 thousand barrels of oil equivalent per day (mboed) in 2023, reflecting a 27 mboed increase compared to 2022. Significant contributions came from the Rubiales and Caño Sur Fields in Colombia and the Permian in the United States. Notably, secondary and tertiary recovery methods accounted for approximately 41% of daily production, primarily through air and water injection in Chichimene and Castilla.

In the midstream segment, total transported volumes for 2023 amounted to 1,113 thousand barrels per day (mbd), marking a 42 mbd increase compared to 2022, leveraging a historic EBITDA of the segment in 2023 of COP 11.8 trillion. This increase was primarily attributed to more significant crude oil volumes transported due to increased production in the Llanos region, enhanced refinery production, and operational optimizations in transportation systems.

The downstream segment achieved a record annual throughput of 420 thousand barrels per day (kbd), alongside a gross integrated margin of 17.6 USD per barrel. This success was driven by the continuous operation of the Cartagena Crude Plants Interconnection (IPCC) and an average operational availability of 95%, the highest in the last 5 years.

On the commercial front, establishing the commercial subsidiary Ecopetrol US Trading (EUST) during 4Q23 marked a significant milestone. EUST achieved an EBITDA of USD 19.5 million and sold 9.3 million barrels of crude oil and products in its inaugural quarter of operation. Additionally, our subsidiary Ecopetrol Trading Asia continued to strengthen its presence in the Asian market, with approximately 53% of our exports directed to the continent.

In the low-emission solutions business line, natural gas and liquified petroleum gas (“LPG”) contributed 22% of the Group’s total production during 4Q23. In renewables, we avoided emitting approximately 26,294 tons of CO2 equivalent, which were reduced through the operation of our Brisas, Castilla, and San Fernando solar parks, CENIT solar parks, and the Cantayús Small Hydroelectric Plant.

As part of our commitment to incorporating non-conventional sources of renewable energy into our energy matrix, we have integrated 472 MW (under construction, operation, and execution). Additionally, in the field of energy efficiency, optimization of 3.89 PJ (thermal energy 3.37 PJ and electrical energy 0.52 PJ) was achieved, resulting in a reduction of emissions by 274 thousand tons of CO2 equivalents in the Group operations, thanks to the adoption of energy optimization technologies.

In the transmission and toll roads business line, notable operational and financial achievements were recorded in 2023, contributing close to 15% (COP 9.1 trillion) to the Group’s EBITDA. Several projects were awarded and commenced operations in Latin America during this period. In Chile, ISA Intervial was awarded the Orbital Sur Santiago concession with a reference CAPEX of USD 500 million (~ COP 1.9 trillion). In Peru, in consortium with Grupo Energía de Bogotá, construction projects totaling USD 833 million (~ COP 3.2 trillion) were awarded.

Regarding TESG results:

Concerning our commitment to the environment, around 39 million cubic meters of water were reused in operations during 4Q23, helping to alleviate pressure on water resources. Additionally, 581,532 tons of CO2 equivalent was reduced throughout the year, surpassing the established target by 40%. Moreover, there was an impressive 76% decrease in events associated with operations affecting the environment, marking the best performance in this area in the last five years.

Leave a Reply